On or about 18 Feb 2022, the Minister for Finance, Mr. Lawrence Wong, delivered his Budget Statement for the Financial Year 2022.

Tax changes – Individuals

Enhance the progressivity of Personal Income Tax (“PIT”) of tax-resident individual taxpayers

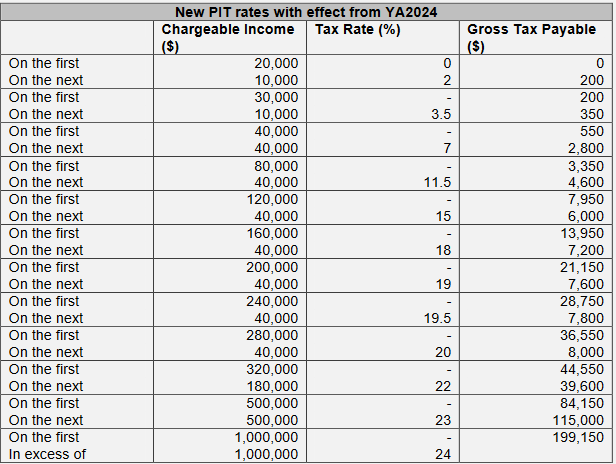

The top marginal personal income tax rate for resident individual taxpayers will be increased with effect from Year of Assessment (YA) 2024. The portion of chargeable income in excess of $500,000 up to $1 million will be taxed at 23%, while that in excess of $1 million will be taxed at 24%; both up from 22%.

The new personal income tax rate structure for resident individual taxpayers, with effect from YA 2024, is as follows:

Table 1: New personal income tax rates with effect from YA 2024

The corresponding changes to the personal income tax rates for non-resident individual taxpayers (except on employment income and certain income taxable at reduced withholding tax rates) will correspondingly be raised from 22% to 24%.

Extend the WHT exemption for non-tax resident mediators

The withholding tax exemption for non-resident mediators, which is scheduled to lapse on 31 March 2022, will be extended till 31 March 2023.

From 1 April 2023 to 31 Dec 2027, gross income derived by non-tax-resident mediators from mediation work carried out in Singapore will be subject to a concessionary withholding tax rate of 10%, subject to conditions.

Alternatively, non-resident mediators may elect to be taxed at 24% on the net income, instead of 10% on gross income.

Extend the WHT exemption for non-tax resident arbitrators

The withholding tax exemption for non-resident arbitrators, which is scheduled to lapse on 31 March 2022, will be extended till 31 March 2023.

From 1 April 2023 to 31 Dec 2027, gross income derived by non-tax-resident arbitrators from arbitration work carried out in Singapore will be subject to a concessionary withholding tax rate of 10%, subject to conditions.

Alternatively, non-tax resident arbitrators may elect to be taxed at 24% on the net income, instead of 10% on gross income.