On or about 18 Feb 2022, the Minister for Finance, Mr. Lawrence Wong, delivered his Budget Statement for the Financial Year 2022.

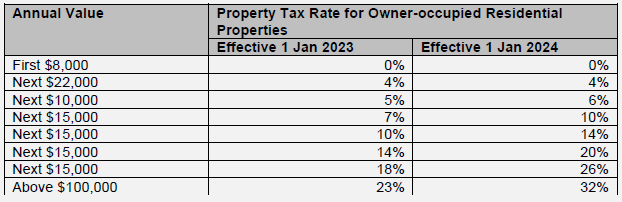

Enhance the progressivity of property tax for owner-occupied residential properties

The progressive property tax rates for owner-occupied residential properties will be revised for the portion of annual value in excess of $30,000.

This change will be phased in over 2 years as shown in Table 2 below, starting with property tax payable in 2023.

This increase of property tax rates for owner-occupied residential properties affects only residential properties with annual values over $30,000.

Table 2: Property tax rates for owner-occupied residential properties

The final property tax rates of up to 32% will take effect for property tax payable from 1 January 2024.

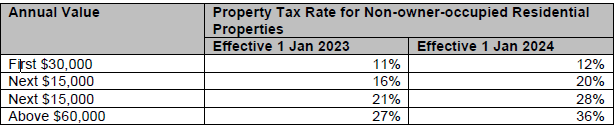

Enhance the progressivity of property tax for non-owner occupied (such as vacant, or let-out) residential properties

The progressive property tax rate schedule for non-owner-occupied residential properties will be revised. This change will be phased in over 2 years as shown in Table 3 below, starting with property tax payable in 2023.

This change will affect all non-owner-occupied residential properties.

Table 3: Property tax rates for non-owner-occupied residential properties